Tax Brackets 2025 Explained For Seniors

BlogTax Brackets 2025 Explained For Seniors - Federal Tax Brackets 2025 For Seniors Kirby Carilyn, These changes are now law. If you’re a single taxpayer. 2025 Tax Code Changes Everything You Need To Know RGWM Insights, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the. Each of the seven rates will apply to the tax brackets for 2025:

Federal Tax Brackets 2025 For Seniors Kirby Carilyn, These changes are now law. If you’re a single taxpayer.

New Tax Brackets for 2025 YouTube, By leveraging higher tax exemption. To protect against scams, harris said implementing stringent verification processes for any requests involving money or sensitive information is critical.

Tax Bracket 2025 Table Kiley Merlina, You pay tax as a percentage of your income in layers called tax brackets. The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the.

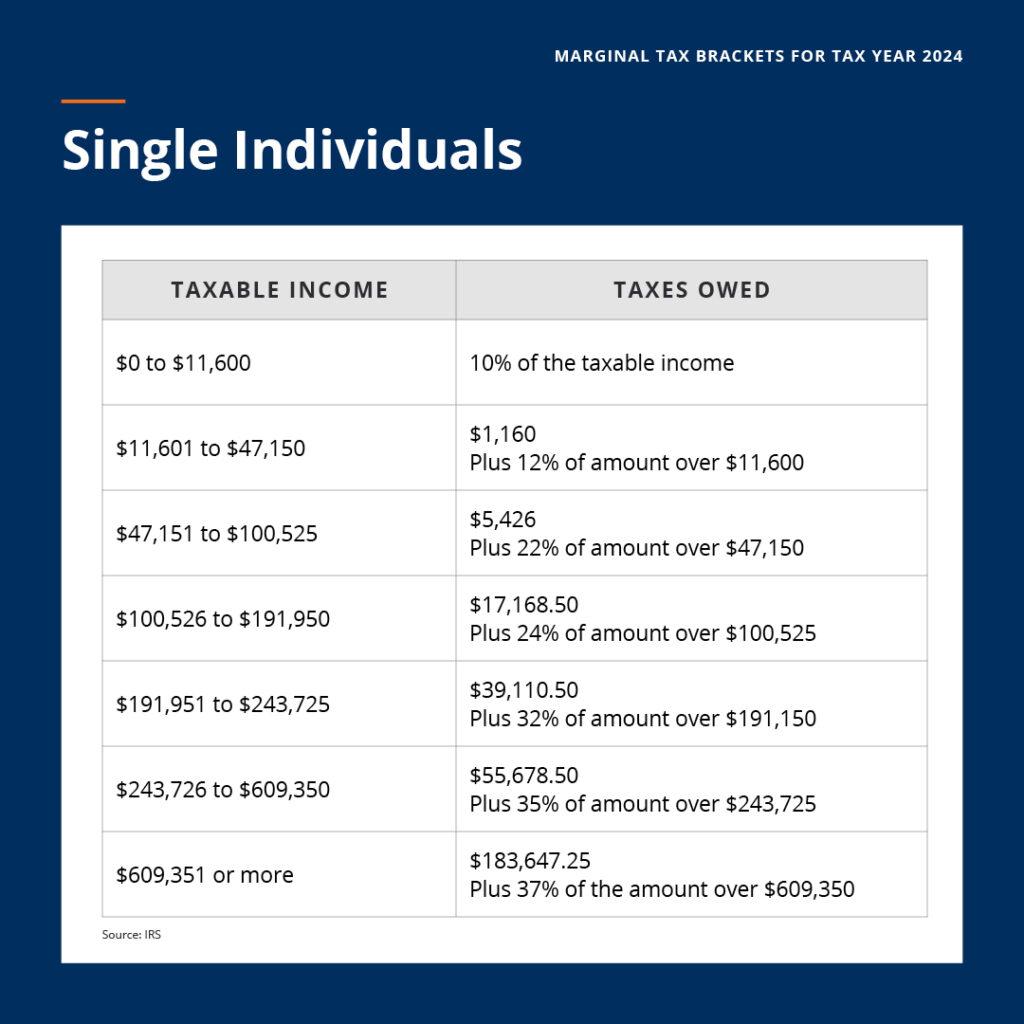

The table shows the tax brackets that affect seniors, once you include, Your bracket depends on your taxable income and filing status. Fact checked by kirsten rohrs schmitt.

Chalmers estimates that disposable income will grow by an average of 3.5% this year,.

2025 Vs 2025 Irs Tax Brackets Sammy Angelina, How do you reduce the amount of taxes you owe? For 2025, the lowest rate of 10% will apply to individuals with taxable income up to $11,600 and joint filers up to $23,200.

IRS Announces New 2025 Tax Brackets Queen Financial Services, If you’re a single taxpayer. For incomes up to $11,600 ($23,200 for married couples filing jointly) 12%:

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Tax brackets 2025 explained for seniors eva jemimah, changes to individual income tax rates and thresholds from 1 july 2025. There are seven (7) tax rates in 2025.

Tax Brackets 2025 Explained For Seniors. Each of the seven rates will apply to the tax brackets for 2025: The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets and and Federal Tax Rates pdfFiller Blog, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year.

2025 Tax Brackets Announced What’s Different?, Chalmers estimates that disposable income will grow by an average of 3.5% this year,. By leveraging higher tax exemption.

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). These rates apply to your taxable income.